|

Getting your Trinity Audio player ready...

|

If you are looking for personal finance books that actually work, you have probably realized there is too much noise out there. I have spent the last decade reading everything from dusty classics to modern viral hits, and I can tell you: most money advice is just common sense packaged differently.

But the right book? The right book can flip a switch in your brain. It stops being about math and starts being about freedom. Whether you are drowning in student loans, scared of the stock market, or just tired of living paycheck to paycheck, one of these books has the answer you need.

Here is my no-nonsense list of the 10 best personal finance books that cut through the fluff and deliver real results.

Table of Contents

Toggle1. Rich Dad Poor Dad – Robert Kiyosaki

What the book is about

This is the book that started it all for millions of people, including me. It is a story of two fathers: one highly educated but poor, and one a high-school dropout who became a multimillionaire. Kiyosaki challenges the idea that a high income makes you rich.

Key lessons

Assets vs. Liabilities: The most famous lesson. Assets put money in your pocket; liabilities take money out. Your house is likely a liability, not an asset.

Financial Literacy: You don’t need to be a genius; you just need to understand how money flows.

Mindset: The rich don’t work for money; they make money work for them.

Who should read it

Complete beginners who need a mindset shift. If you think “getting a good job” is the only path to wealth, read this first.

2. The Psychology of Money – Morgan Housel

What the book is about

Morgan Housel doesn’t talk about spreadsheets or stock picks. He talks about how your brain works. This book explains why smart people do stupid things with money and how your ego and envy are bigger enemies than inflation.

Key lessons

Wealth is what you don’t see: Spending money to show people how much money you have is the fastest way to have less money.

Compounding: It’s not just about returns; it’s about endurance. Survival is the key to growth.

Reasonable > Rational: It’s better to have a financial plan you can stick to (reasonable) than a mathematically perfect one you will quit (rational).

Who should read it

Everyone. Literally everyone. It is less of a finance book and more of a life philosophy book.

3. The Total Money Makeover – Dave Ramsey

What the book is about

Dave Ramsey is the drill sergeant of personal finance. He hates debt with a passion. This book provides a strict, step-by-step plan (The Baby Steps) to get out of debt and build an emergency fund.

Key lessons

The Debt Snowball: Pay off your smallest debts first to get a psychological win, regardless of interest rates.

Cash is King: Cut up the credit cards. If you can’t pay cash, you can’t afford it.

Emergency Fund: Before you invest, save $1,000 fast, then 3–6 months of expenses.

Who should read it

People drowning in credit card debt or who have zero self-control with spending. If you need someone to yell at you to get your act together, this is it.

4. Think and Grow Rich – Napoleon Hill

What the book is about

Published in 1937, this is the grandfather of self-help. Hill interviewed the wealthiest people of his time (like Andrew Carnegie and Henry Ford) to find the “secret” to success. It’s less about money tactics and more about the mental discipline required to build wealth.

Key lessons

Desire: You must have a burning desire for wealth, not just a wish.

The Mastermind Group: Surround yourself with people who are smarter than you and share your vision.

Persistence: Failure is just a temporary detour, not a dead end.

Who should read it

Entrepreneurs and dreamers. If you need motivation and belief in yourself, pick this up.

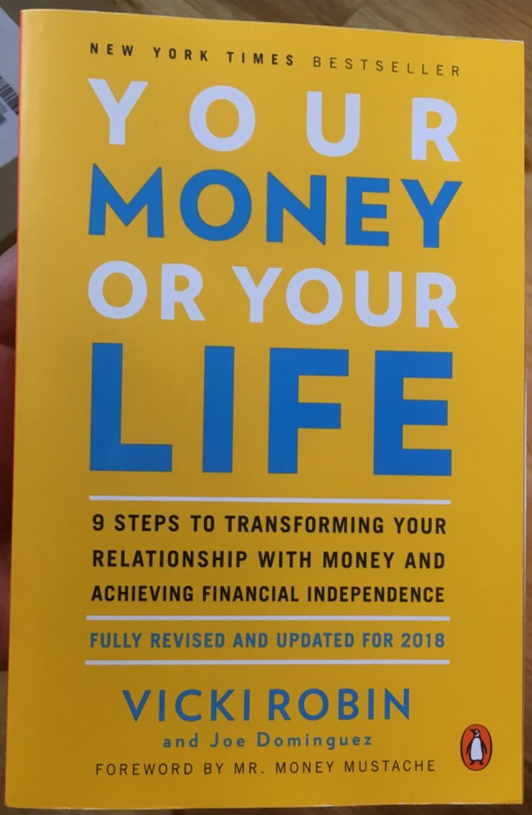

5. Your Money or Your Life – Vicki Robin

What the book is about

This book birthed the FIRE (Financial Independence, Retire Early) movement. It forces you to look at money not as currency, but as “life energy.” How many hours of your life did you trade for that new iPhone?

Key lessons

The Crossover Point: The moment your investment income exceeds your monthly expenses, you are free.

Calculate Your Real Hourly Wage: Factor in commute time, work clothes, and stress-relief spending. You earn less than you think.

Conscious Spending: Spend extravagantly on what brings you joy, and cut mercilessly on what doesn’t.

Who should read it

People who hate their jobs and want a roadmap to quit. It is perfect for those seeking deep lifestyle changes.

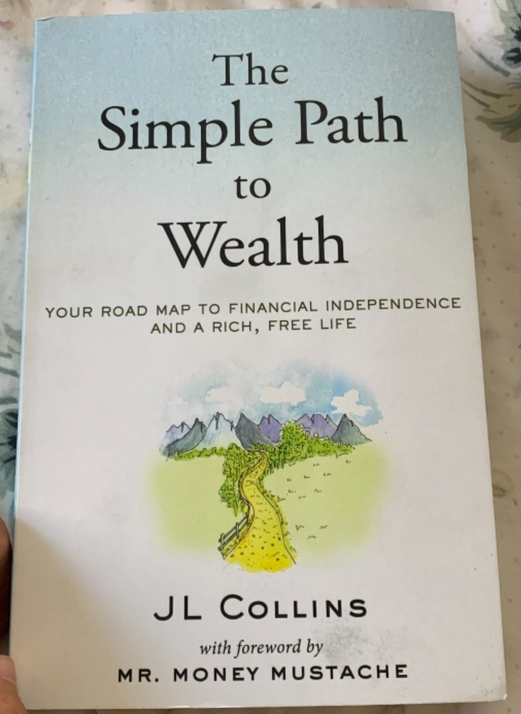

6. The Simple Path to Wealth – JL Collins

What the book is about

JL Collins wrote this originally as letters to his daughter. It is the definitive guide to index fund investing. He simplifies the terrifying world of the stock market into a strategy that a 10-year-old could follow.

Key lessons

VTSAX and Chill: Invest in low-cost, broad market index funds (like Vanguard’s Total Stock Market Index).

Avoid Advisors: Most financial advisors cost too much and underperform the market.

F-You Money: Having savings gives you the power to walk away from a bad job or a bad boss.

Who should read it

Anyone intimidated by the stock market. If you want to invest but don’t want to watch charts all day, read this.

7. I Will Teach You to Be Rich – Ramit Sethi

What the book is about

Ramit Sethi is the anti-Dave Ramsey. He doesn’t want you to cut out lattes; he wants you to earn more and automate your finances. This book is a practical, 6-week program to set up your financial life on autopilot.

Key lessons

Automate Everything: Set up your accounts so money moves to savings and investments automatically.

The Big Wins: Don’t worry about saving $3 on coffee. Worry about negotiating your salary, your rent, and your car loan.

Rich Life: Define what a “rich life” means to you. It might be traveling for a month or buying expensive shoes.

Who should read it

Young professionals and millennials who want to enjoy life now while still building wealth for later.

8. The Millionaire Next Door – Thomas J. Stanley

What the book is about

This book shattered the image of what a millionaire looks like. Through extensive research, the authors found that most millionaires don’t drive Ferraris or live in mansions. They live in modest homes, drive used cars, and are boringly consistent.

Key lessons

Big Hat, No Cattle: Many people with high incomes have low net worth because they spend it all on status symbols.

Frugality: The cornerstone of wealth is living well below your means.

PAW vs. UAW: Are you a Prodigious Accumulator of Wealth or an Under Accumulator of Wealth?

Who should read it

High earners who wonder why they are still broke. It’s a great reality check on status vs. wealth.

9. Atomic Habits – James Clear

What the book is about

While not strictly a finance book, Atomic Habits is essential for money management. Personal finance is 80% behavior. Clear’s framework for building good habits and breaking bad ones is the best tool for sticking to a budget.

Key lessons

1% Better: You don’t need to get rich overnight. You just need to improve your financial habits by 1% every day.

Systems > Goals: Forget about the goal of “saving $1 million.” Focus on the system of automating $500 a month.

Identity Shift: Don’t say “I’m trying to save.” Say “I am a saver.”

Who should read it

People who know what to do but can’t seem to actually do it.

10. The Richest Man in Babylon – George S. Clason

What the book is about

This book uses parables set in ancient Babylon to teach financial wisdom. It sounds dry, but it’s surprisingly readable. The advice is thousands of years old, yet it applies perfectly to modern life.

Key lessons

Pay Yourself First: For every 10 coins you earn, keep one for yourself. (Save 10%).

Live Below Your Means: Control your expenses so they don’t equal your income.

Make Gold Multiply: Invest your savings so they earn interest.

Who should read it

Fans of stories and parables. If you find modern finance books boring, this narrative style might stick with you.

My Personal Experience With Personal Finance Books

I used to roll my eyes at the “self-help” section of the bookstore. I thought money was simple math: earn minus spend equals savings. But my bank account didn’t agree.

The turning point for me wasn’t a budgeting app; it was reading The Psychology of Money. It made me realize that my problem wasn’t math—it was my ego. I was spending money to keep up with friends who were just as broke as I was.

Then, The Simple Path to Wealth took away my fear of the stock market. I went from hoarding cash (and losing to inflation) to confidently buying index funds.

I’ve read dozens of personal finance books, and I can honestly say that reading just one good one is better than reading none. But reading three or four? That’s when you start building a philosophy that actually fits your life.

Comparison Table

| Book Name | Author | Difficulty | Best For | Core Focus |

| Rich Dad Poor Dad | Robert Kiyosaki | Easy | Beginners | Mindset |

| Psychology of Money | Morgan Housel | Easy | Everyone | Mindset / Behavioral |

| Total Money Makeover | Dave Ramsey | Easy | Debtors | Budgeting / Debt |

| Think & Grow Rich | Napoleon Hill | Medium | Entrepreneurs | Mindset |

| Your Money or Your Life | Vicki Robin | Medium | Early Retirees | Lifestyle / Habits |

| Simple Path to Wealth | JL Collins | Medium | Investors | Investing |

| I Will Teach You to Be Rich | Ramit Sethi | Easy | Millennials | Systems / Automation |

| Millionaire Next Door | Thomas J. Stanley | Medium | High Earners | Habits / Frugality |

| Atomic Habits | James Clear | Easy | Procrastinators | Habits |

| Richest Man in Babylon | George S. Clason | Easy | Story Lovers | Fundamental Laws |

Conclusion

The best personal finance book is the one you actually read and apply.

If you are in deep debt, grab The Total Money Makeover. If you want to invest but feel lost, buy The Simple Path to Wealth. If you just need a kick in the pants to start caring, read Rich Dad Poor Dad.

Don’t just read them. Highlight them. Dog-ear the pages. And most importantly, take action on one thing you learn. A book on a shelf won’t make you rich, but the lessons inside just might.