|

Getting your Trinity Audio player ready...

|

Financial planning for business owners is rarely the reason entrepreneurs start companies. You started your business because you had a passion, a skill, or a vision to solve a problem—not because you wanted to spend your weekends staring at spreadsheets or deciphering IRS tax codes.

However, after over a decade of advising self-employed professionals and running my own consultancy, I can tell you this: the business owners who survive (and thrive) aren’t always the ones with the best product. They are the ones who master their finances.

Whether you are a freelancer, an LLC owner, or running an S-Corp with employees, bridging the gap between your business revenue and your personal wealth is the hardest challenge you will face.

This guide goes beyond basic bookkeeping. We will dive into the strategies, pitfalls, and real-world realities of managing wealth when your income is variable and the buck stops with you.

Why Financial Planning Matters for Business Owners

If you work a W-2 job, financial planning is relatively linear. You get a paycheck, taxes are withheld automatically, and you contribute to a 401(k).

When you are the boss, that safety net disappears. Financial planning for business owners is dynamic and high-stakes. It requires you to wear two hats simultaneously: the CFO of your company and the CEO of your household.

Without a cohesive plan, you face significant risks:

- Tax Inefficiency: Paying the IRS more than necessary because you missed deductions or structural advantages.

- Cash Flow Crunches: having high revenue on paper but no cash to pay vendors (or yourself).

- Retirement Gaps: Waking up at 60 realizing your business is your only asset, which is a dangerous basket to put all your eggs in.

Effective planning creates a firewall between you and chaos. It allows you to pay yourself consistently, scale operations, and eventually exit the business on your terms.

Core Pillars of Financial Planning for Business Owners

To move from “surviving” to “wealth building,” you need to address five specific pillars. These interact with each other; pulling a lever in one area often affects the others.

1. Cash Flow Management

Cash is the oxygen of your business. Profit is a theory; cash is a fact.

Many business owners confuse the two. You can invoice $50,000 this month (revenue) and show a great P&L statement (profit), but if those clients don’t pay for 60 days, you are insolvent next week.

A solid financial plan requires a 13-week cash flow forecast. This helps you predict:

- When large expenses are due.

- When to hire.

- When to pause spending.

2. Strategic Tax Planning

For W-2 employees, taxes are a yearly compliance event. For business owners, taxes are a year-round strategy.

This involves more than just saving receipts. It involves entity structure analysis. For example, moving from a Sole Proprietorship to an S-Corp can save thousands in self-employment taxes once your net income exceeds a certain threshold (often around $70k–$90k net, though this varies by state).

It also involves timing. Should you buy that equipment in December to lower this year’s taxable income, or wait until January?

3. Risk Management

What happens if you get sick? What happens if you get sued?

In the corporate world, you have benefits. In your world, you need to buy them. Essential protections include:

- General Liability & Professional Liability (E&O): Protecting against lawsuits.

- Disability Insurance: Statistically, you are more likely to be disabled than die during your working years. If you can’t work, the revenue stops.

- Key Person Insurance: If you have a partner or a top salesperson, what happens to the business if they pass away?

4. Retirement Planning

“My business is my retirement” is a common refrain I hear. It is also a high-risk gamble. Industries change, and valuations plummet. You need diversification.

The U.S. tax code offers powerful tools for business owners to shelter income:

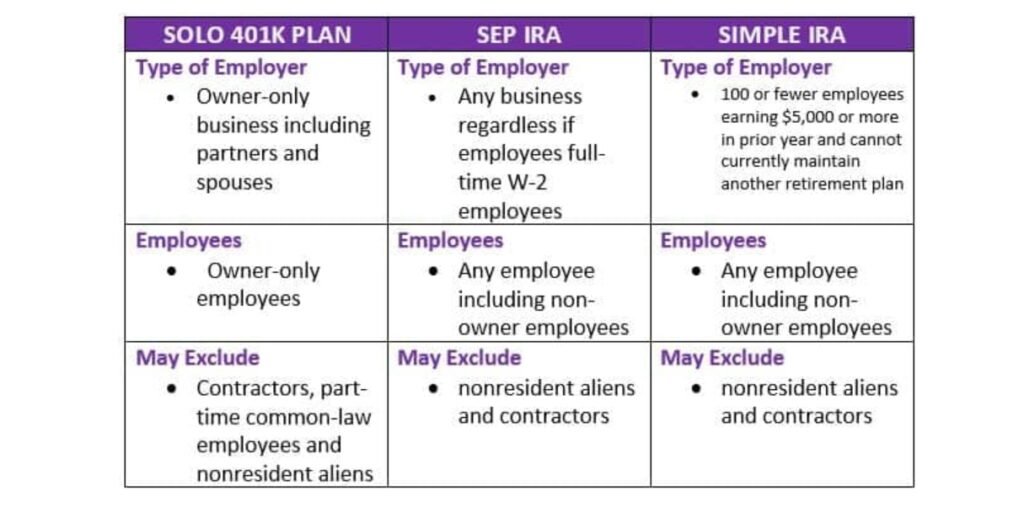

- SEP IRA: Easy to set up, high contribution limits (up to 25% of compensation).

- Solo 401(k): Often the “gold standard” for owner-only businesses, allowing both employee and employer contributions.

- Cash Balance Plans: For high-earning business owners looking to shelter over $100k annually.

5. Business Growth and Exit Planning

Are you building a lifestyle business to fund your life now, or an asset to sell later?

Financial planning helps you determine your “number.” If you plan to sell, your financials need to be clean, audit-ready, and show a trend of growth. If you don’t plan to sell, you need a succession plan or a strategy to wind down without tax penalties.

Common Financial Mistakes Business Owners Make

Even smart entrepreneurs fall into these traps. Financial planning for business owners often fails because of behavioral errors rather than mathematical ones.

- Co-mingling Funds: This is the cardinal sin. Using your business card for groceries or your personal card for software subscriptions pierces the “corporate veil.” It makes bookkeeping a nightmare and can get you in trouble with the IRS or in legal disputes.

- Operating Without a Buffer: Every business should have 3 to 6 months of operating expenses in a liquid savings account. This is your “sleep well at night” fund.

- Ignoring Estimated Taxes: The U.S. tax system is “pay as you go.” Waiting until April 15th to pay your tax bill usually results in underpayment penalties.

- Stagnant Pricing: Inflation affects your costs. If you haven’t raised your prices in two years, you have technically given yourself a pay cut.

My Experience: The Revenue Trap

I want to share a story from my early days as a consultant that shaped how I view financial planning for business owners.

I was working with a client—let’s call him Mark. Mark ran a boutique marketing agency. On the surface, he was crushing it. He hit $750,000 in revenue that year, bought a new truck, and hired two expensive senior managers.

When we sat down in November to look at his personal financial plan, the mood shifted. Despite three-quarters of a million dollars flowing through the business, Mark had $4,000 in his personal checking account and hadn’t contributed a dime to his SEP IRA.

He fell into the Revenue Trap.

Mark was making spending decisions based on his top-line revenue ($750k) rather than his bottom-line profit (which, after overhead and payroll, was closer to $90k). He was living a lifestyle his business couldn’t actually support.

We had to have a hard conversation. We implemented a “Profit First” style system. We opened separate bank accounts for taxes, profit, and operating expenses. He hated it for three months because he felt “broke.”

But by the next tax season, the money was there. He fully funded his retirement account for the first time in five years.

The Lesson: Your business bank balance is not your money. It belongs to the business, the IRS, and your vendors first. You get what’s left—so you better plan to make sure there is something left.

How Business Owners Can Get Started Today

If you feel behind, don’t panic. You can course-correct. Here is a practical checklist to professionalize your financial planning immediately.

1. Separate Church and State

If you haven’t already, open a dedicated business checking account and a dedicated business credit card. Move all automated transactions to these accounts.

2. Build Your Financial Board of Directors

You cannot do this alone. You need a team. At a minimum, this includes:

- A CPA (Certified Public Accountant): For tax filing and strategy.

- A Bookkeeper: To categorize transactions monthly (do not do this yourself if you bill more than $50/hr).

- A CFP® (Certified Financial Planner): Ideally one who specializes in business owners, to help integrate your business assets with your personal goals.

3. Implement a “Pay Yourself First” Structure

Set up a recurring transfer from your business to your personal account. Treat it like a W-2 salary. It stabilizes your personal budget and forces the business to operate on the remaining cash.

4. Review Your Numbers Monthly

Set a “Money Date” on the 5th of every month. Review your Profit & Loss (P&L) statement. Look at two numbers: Net Income and Cash Flow. If you don’t know the difference, ask your accountant to teach you.

Conclusion

Financial planning for business owners is about buying freedom. It is about knowing that if a client leaves, you have reserves. It is about knowing that when you retire, you aren’t dependent on selling your business for a unicorn price.

The U.S. tax code and financial system are actually designed to benefit business owners—but only those who play by the rules and plan ahead.

Don’t wait until you are “rich enough” to plan. The planning is what gets you there. Start small, separate your accounts, and treat your financial health with the same intensity you treat your product quality.

Disclaimer: I am a financial content writer, not your personal financial advisor or attorney. Tax laws and regulations in the United States change frequently. Always consult with a qualified CPA, tax attorney, or CFP® regarding your specific business situation before making major financial decisions.

Pingback: 5-Year Example of Financial Forecast in Business Plan: A Proven Guide for Startups