|

Getting your Trinity Audio player ready...

|

The financial planning process is often misunderstood. Many people think it’s just about picking the right stocks or knowing how to file taxes without an audit. In reality, it is the comprehensive roadmap that connects where you are today with where you want to be in ten, twenty, or thirty years.

If you have ever felt like you are earning decent money but not actually building anything, you are likely missing this structural foundation. I’ve seen high earners live paycheck to paycheck, and I’ve seen modest earners retire as millionaires. The difference is rarely luck; it is almost always adherence to a plan.

This guide covers the essential steps of the financial planning process, tailored for real life in the U.S. economy, to help you move from financial stress to financial clarity.

What Is the Financial Planning Process?

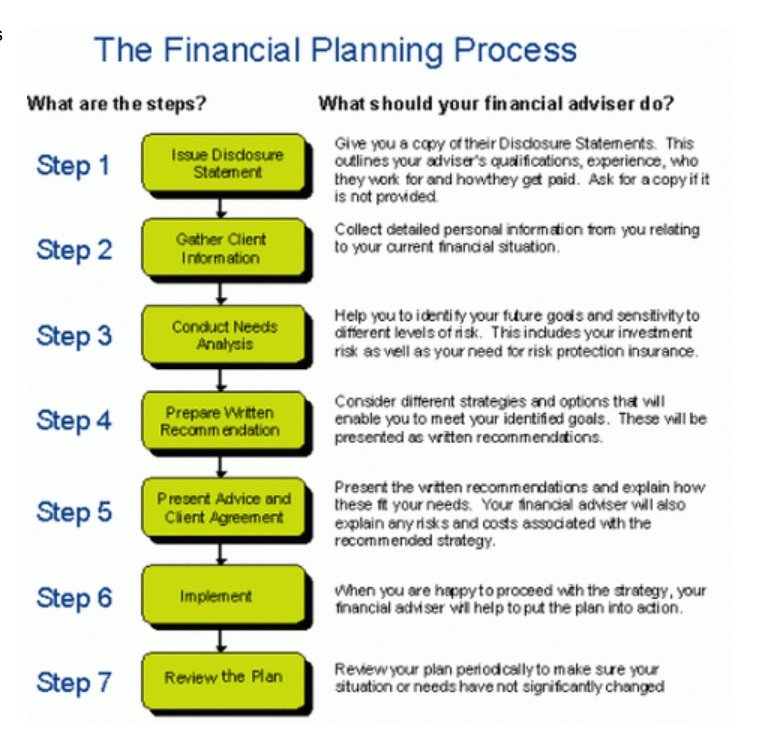

The financial planning process is a logical, six-step procedure used to manage your financial situation to achieve life goals. It isn’t a one-time event where you fill out a spreadsheet and forget it. It is an ongoing cycle of evaluating, strategizing, and adjusting.

Think of it like using a GPS. You need to know your current location (finances today), your destination (goals), and the best route to get there (strategy), while recalculating for traffic or road closures (life events).

Without this process, you are essentially driving blind. You might be moving forward, but you have no guarantee you are heading in the right direction.

The 6 Key Steps of the Financial Planning Process

Whether you are working with a Certified Financial Planner (CFP®) or taking the DIY route, these are the standard steps recognized in the industry to create a robust plan.

1. Establishing and Defining the Client-Planner Relationship

If you are doing this yourself, this step is about establishing a relationship with yourself and your money. You need to commit to the process.

If you are hiring a professional, this is where you define the scope of engagement. Are you looking for a one-time portfolio review, or ongoing wealth management? Clarity here prevents disappointment later.

2. Gathering Client Data and Determining Goals

You cannot plan a route if you don’t know where you are starting. In this stage of the financial planning process, you must be brutally honest about the numbers.

You need to gather:

- Assets: Bank balances, 401(k) statements, home equity, car values.

- Liabilities: Credit card debt, student loans, mortgage balances.

- Cash Flow: What comes in (net income) vs. what goes out (expenses).

Once the data is clear, you define your goals. “I want to be rich” is not a goal. “I want to retire at 55 with $6,000 in monthly after-tax income” is a goal.

3. Analyzing and Evaluating Your Financial Status

Now, we look at the gap between Step 1 and Step 2.

Does your current savings rate support your retirement goal? Is your debt-to-income ratio too high to qualify for a mortgage? This is the diagnostic phase. We look for strengths (a good credit score, a company match on your 401k) and weaknesses (no emergency fund, high-interest consumer debt).

4. Developing and Presenting Financial Planning Recommendations

This is the strategy phase. Based on your analysis, you develop specific courses of action. usually, there are alternatives to weigh.

For example, if you have $1,000 in surplus cash flow, should you:

- Pay down a 7% car loan?

- Invest in a Roth IRA hoping for an 8% return?

- Build your emergency fund?

A good financial planning process weighs the mathematical outcome against the psychological benefit. Sometimes, paying off the debt is the right move simply for the peace of mind, even if the math says invest.

5. Implementing the Financial Planning Recommendations

A plan without action is just a wish. This is often the hardest part.

Implementation involves:

- Actually opening the brokerage account.

- Changing your W-4 withholding to fix tax issues.

- Calling the insurance agent to increase your liability coverage.

- Setting up the automatic transfer to your savings account.

Procrastination here is the wealth-killer. The “perfect” plan implemented next year is far worse than a “good” plan implemented today.

6. Monitoring the Financial Planning Recommendations

Life happens. You get married, you have a child, tax laws change, or the market corrects.

The financial planning process requires you to review your plan at least annually or after any significant life event. If you don’t monitor your progress, your plan becomes obsolete the moment your circumstances change.

My Experience with the Financial Planning Process

I’ll be honest: early in my career, I was a hypocrite. I was helping clients structure their wealth, but my own finances were a mess of disconnected decisions.

I treated my money like a junk drawer. I had a checking account here, an old 401(k) from a previous job forgotten there, and no idea how much I was actually spending on dining out. I convinced myself I didn’t need a formal financial planning process because I “knew the industry.”

The wake-up call came when my wife and I decided we wanted to buy our first home. I pulled my credit report and looked at our liquid savings. Despite a good income, we had almost nothing accessible for a down payment. We were “income affluent” but “balance sheet poor.”

I had to sit down and treat myself like a client. I went through the steps:

- The Audit: I realized we were bleeding cash on subscriptions and convenience fees.

- The Goal: We needed $40,000 in 18 months.

- The Strategy: We paused all taxable investing and diverted that cash flow to a high-yield savings account (HYSA) to preserve capital. We cut dining out by 50%.

- Monitoring: We tracked our net worth on a spreadsheet every single Friday.

The psychological shift was immediate. Before the plan, spending money felt guilty because I didn’t know if I could afford it. After the plan, I spent money guilt-free because I knew my savings bucket was already filled. The process didn’t restrict me; it liberated me.

Core Components Every Plan Needs

When you are building out your strategy, ensure you are covering these five pillars.

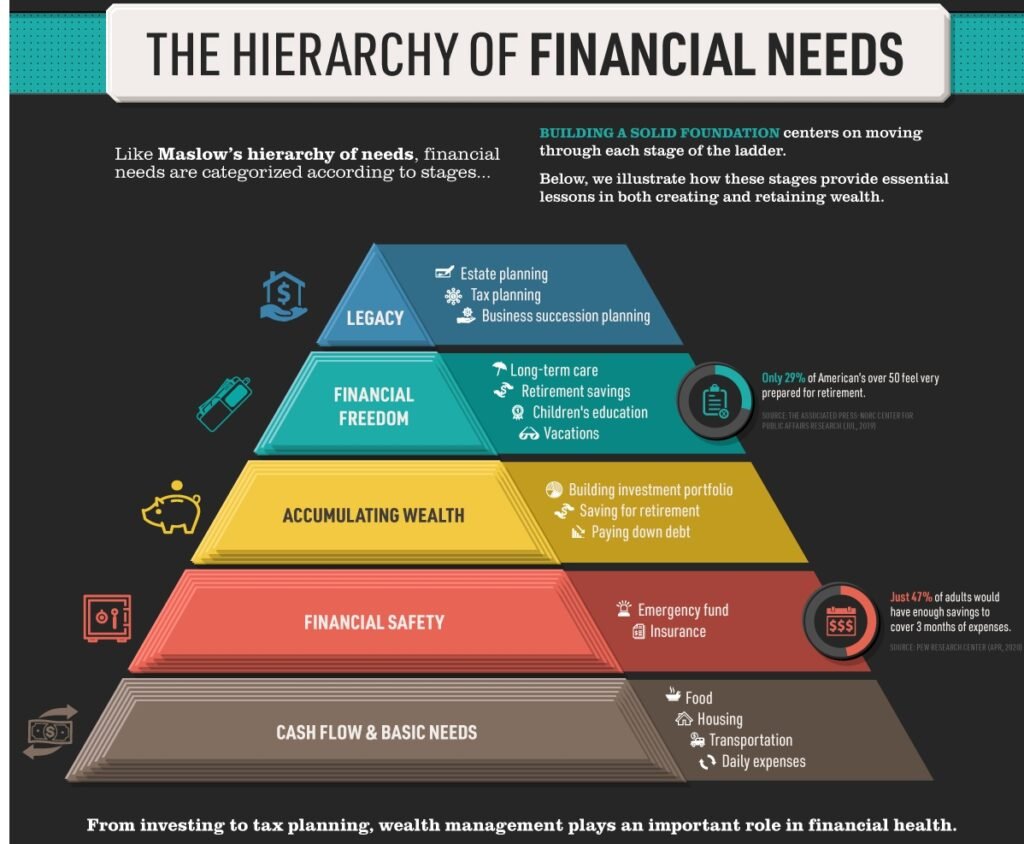

1. Cash Flow & Budgeting

You cannot out-invest a bad spending habit. You need a system (like the 50/30/20 rule or zero-based budgeting) to ensure you spend less than you earn. This is the fuel for the rest of the engine.

2. Risk Management (Insurance)

One medical emergency or lawsuit can wipe out decades of saving.

- Health Insurance: Non-negotiable in the U.S.

- Life Insurance: Term life is usually best for families to replace lost income.

- Disability Insurance: Often overlooked, but vital if you rely on a paycheck.

3. Investment Planning

This is where you grow wealth to outpace inflation. For most Americans, this means utilizing tax-advantaged accounts like 401(k)s, 403(b)s, and IRAs. The focus here should be on asset allocation (stocks vs. bonds) and keeping fees low, rather than trying to pick “winning” stocks.

4. Tax Planning

It’s not about evading taxes; it’s about efficiency. This involves strategies like:

- Harvesting losses to offset gains.

- Choosing between Traditional (pre-tax) and Roth (post-tax) contributions based on your current vs. future tax bracket.

- Understanding capital gains implications before selling assets.

5. Estate Planning

It sounds morbid, but it’s an act of love. You need a Will, a Living Will (medical directives), and a Power of Attorney. If you have kids, naming a guardian is part of the financial planning process you cannot ignore.

Common Pitfalls to Avoid

Even with the best intentions, I see people fall into these traps repeatedly.

Confusing Planning with Investing Buying Bitcoin or Tesla stock is not a financial plan. That is a speculative investment decision. A plan answers why you are buying it and how it fits into your overall risk profile.

Ignoring Inflation If you stuff cash under your mattress (or in a checking account earning 0.01%), you are losing money every year. A sound financial planning process accounts for the fact that a dollar today will buy less in 20 years.

Letting the “Perfect” be the Enemy of the Good I see people paralyzed because they don’t know if they should save $500 or $550. It doesn’t matter. Just start with the $500. You can optimize later. The most important variable in compounding interest is time, not perfect precision.

Forgetting to Update Beneficiaries I once saw a life insurance payout go to an ex-spouse because the policyholder forgot to update the paperwork after a divorce. The legal document always wins. Make checking your beneficiaries part of your annual review.

Conclusion

The financial planning process is the bridge between your current reality and your future dreams. It provides the framework to make decisions not based on fear or greed, but on logic and long-term vision.

It doesn’t require you to be a math genius or a Wall Street insider. It requires discipline, honesty, and a willingness to course-correct when life throws you a curveball.

Start today. Assess where you are, define where you want to go, and take that first step. Your future self—and your bank account—will thank you.

Pingback: How Can I Save Money Online? 9 Smart Strategies That Actually Work